Resilient Philanthropy: An Optimistic Outlook Emerges from Mixed Data

Economic forecasts and predictions at the beginning of 2023 were pessimistic, and that sentiment took hold of the nonprofit sector mid-year when Giving USA released its report on philanthropy in the year 2022. After years of record-breaking giving totals, giving declined. The generosity of the pandemic era was supplanted by concern over the economy amid the highest rate of inflation seen in decades. Not only had the total dollars given fallen by 1.1%, but when adjusting for inflation, the results were even more severe.

As experts shared this news and its impact with nonprofits, however, economic headwinds were changing. Inflation cooled throughout 2023, while disposable personal income grew by an inflation-adjusted 3.8%, putting more spending power in individuals’ hands. This resulted in a 6.0% growth in consumer spending (1.9% adjusted for inflation) and a rebounding of stock markets that recouped much of the previous year’s losses. Households and the for-profit sector had reason to be optimistic as the year progressed, and as calendars turned to 2024, the clouds that overshadowed the year slowly parted.

Nonprofits would go on to find reasons for optimism throughout the new year.

The generosity inspired by the COVID-19 pandemic and calls for social justice had been stymied by increasing costs and an uncertain but negative outlook on the year ahead. Giving declined in 2022 by 3.4% (10.5% adjusted for inflation) from record highs in 2021. By the end of 2023, however, charitable giving reached an all-time current dollar high of $557.16 billion. While the data paints a more nuanced picture, nonprofits saw once again that philanthropy is resilient.

BWF is pleased to share key findings and analysis from Giving USA 2024: The Annual Report on Philanthropy. Presented by the research team at the Indiana University Lilly School of Philanthropy and fundraising professionals at Giving USA Foundation, the Giving USA report is the longest-running, most extensive report on philanthropy in the United States. BWF is proud to be a member of The Giving Institute.

Key Findings from the Report

- Total estimated charitable giving climbed to a current dollar high of $557.16 billion in 2023, up from $546.61 billion in 2022 and up 1.9% from 2022. When adjusted for inflation, however, charitable giving decreased by 2.1% from 2022 and fell short of the 2021 record–setting all-time high.

- Despite rebounding performance in all four sources of giving, inflation-adjusted results are mixed. All four sources grew in current dollars, but only Bequests grew when adjusted for inflation.

- Giving by individuals remains the largest source of giving at 67% of dollars given, but it continues to shrink as a share of all philanthropy. Individual giving grew 1.6% (-2.4% adjusted for inflation). Individual giving comfortably exceeds pre-pandemic giving but falls short of pandemic and immediate post-pandemic giving.

- Foundation giving exceeded $100 billion for the second time, declining to $103.53 billion in 2023 from 2022’s high of $105.99 billion (an inflation adjusted decrease of -2.3%). Foundation giving continues to grow as a share of overall philanthropy and is currently 19% of charitable giving.

- Bequest giving, which grew to $42.68 billion in 2023, was the only source of giving to outpace inflation, growing by 0.6% in real dollars. Bequest giving continues to hover between 9%-10% of overall giving, growing in dollars to keep pace with the overall expansion of total philanthropic dollars.

- At $36.55 billion, corporate giving posted its second highest total on record and continues to grow over time. Strong pre-tax profits and continued growth of matched gift programs are driving factors of growth from this source.

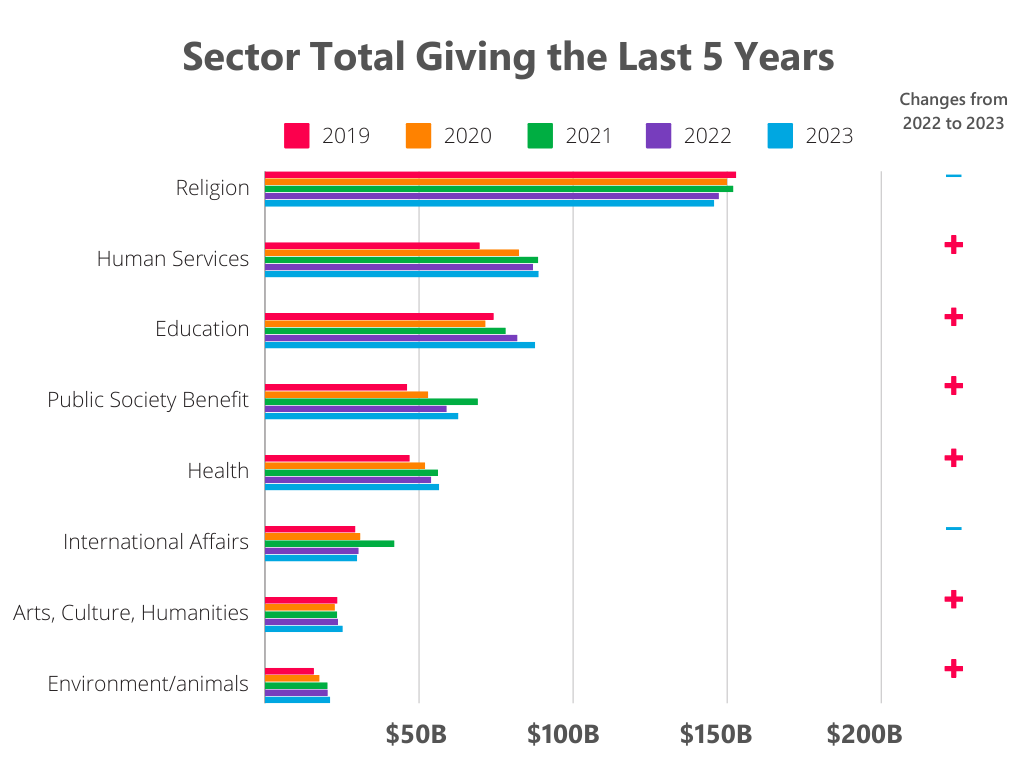

- Giving to most—but not all—philanthropic sectors rose in real dollars. Data from 2023 signifies significant wins for some sectors and continued cause for concern in others.

- Five sectors—education, health, human services, environment/animals, and arts, culture, and humanities—hit all-time highs in contributions received.

- Education grew an inflation adjusted 6.7% to $87.69 billion.

- Human Services giving narrowly surpassed 2021’s total, hitting $88.84 billion in giving, an inflation adjusted growth of 1.7% from 2022 (surpassing 2021’s previous high of $88.70 billion).

- Health giving rebounded, recording a record $56.58 billion in philanthropy. This 4.4% inflation adjusted growth surpasses 2021’s previous record–setting total of $56.20 billion.

- Environment/animals grew to $21.20 billion, a 3.9% inflation adjusted growth that exceeds 2022’s previous record high.

- Arts, culture, and humanities giving grew to $25.26 billion in current dollars, growth of an impressive 6.6% in inflation dollars, exceeding 2022’s previous record high.

- Giving to religion fell 1.0% in inflation adjusted dollars, and international affairs giving fell by 1.6%, somewhat leveling off after a spike in 2021. The trend in international affairs giving continues to be mixed while religion continues a decades–long steady decline in market share.

- Giving to foundations demonstrated the most significant growth rate at 10.8% (adjusted for inflation). Last year was its second strongest in Giving USA history. This growth is fueled in part by investments from donors in community foundation–held Donor Advised Funds (DAF).

- Public-society giving, which includes several large financial institution-managed donor advised funds, rose 7.2% in inflation adjusted dollars to $62.81 billion, far short of 2021’s $69.11 billion high. Nonetheless, this growth is instructive in how donors are giving now in anticipation of future philanthropic investments.

| Inflation adjusted numbers* | 2019 | 2020 | 2021 | 2022 | 2023 | % change from 2022 to 2023 |

| Religion | $153.09B | $150.44B | $152.04B | $147.32B | $145.81B | –1.0% |

| Human Services | $69.73B | $82.47B | $88.70B | $87.39B | $88.84B | +1.7% |

| Education | $74.28B | $71.61B | $78.16B | $82.21B | $87.69B | +6.7% |

| Public Society Benefit | $46.17B | $52.69B | $69.11B | $58.57B | $62.81B | +7.2% |

| Health | $47.45B | $51.58B | $56.20B | $54.21B | $56.58B | +4.4% |

| International Affairs | $29.41B | $30.91B | $42.05B | $30.43B | $29.94B | -1.6% |

| Arts, Culture, Humanities | $23.55B | $22.70B | $23.49B | $23.70B | $25.26B | +6.6% |

| Environment/animals | $15.90B | $17.74B | $20.36B | $20.40B | $21.20B | +3.9% |

Key Takeaways and Trends

Amid Changing Tides, Headline Grabbing Gifts Dominate Headlines, But Not Philanthropy

While a handful of household names dominate the headlines with mega gifts and their departure from grant making business as usual, their gifts garner outsized attention compared to their share of philanthropy. According to ”The Chronicle of Philanthropy,” $11.9 billion of 2023’s total giving (2.14%) is attributable to the top 50 gifts from ultra-high–net–worth individuals. This total does not include $2.1 billion granted by Mackenzie Scott, whose giving constituted 0.3% of overall philanthropy in 2023. These numbers tell an optimistic story for all nonprofits. Those fortunate enough to benefit from the generosity of this handful of philanthropists will see transformative impact, but the pie is more than big enough for all nonprofits who thoughtfully engage donors and foundations to succeed.

Worth watching within these gifts are the shifts in how grants are being made from these ultra-high–net–worth individuals. Rigid grant application and making processes are giving way to impact-oriented philanthropy. This reverses yearslong trends of bigger gifts coming with more strings and instead empowers nonprofit leaders to exercise their best judgement on how to deliver on their missions. As more household name philanthropists add their names to the list of impact-oriented givers, the field will look to see how other donors and foundations do or don’t follow suit.

As Foundations’ Share of Overall Giving Grows, the Individual Giving Total Stays Strong

Individual giving remains the single greatest source of philanthropy in the U.S., but while the number of dollars given away through this source continues to grow (up almost 4% since 2019 to a total of $374.4 billion), this source is shrinking as a percentage of total giving. Foundation giving is up to 19% of overall giving, having crossed the $100 billiion threshold for the second consecutive year. These trends signal that nonprofits should continue concentrating on relationship-based fundraising focused on soliciting individuals while reevaluating and investing in the growing opportunities in foundation giving.

The importance of relationship-based fundraising in building strong ties to individual and family funders becomes clearer when evaluating how dollars across these sources are directed. Individual, bequest, and the family foundation portion of foundation giving accounted for 84% of total philanthropy, meaning giving decisions made by individuals account for a larger share of all decisions than the numbers initially suggested.

Corporate Giving Continues to Grow and Evolve

Corporate giving’s growth as a share of philanthropy is modest, having reached 7% in 2023, but the growth in dollars is significant. Corporate giving is up $7.92 billion since 2019, a growth of nearly 28%. This growth was initially driven by corporate investments in diversity, equity, and inclusion initiatives that began in the summer of 2020 after the murder of George Floyd but has remained strong as corporations enjoy strong pre-tax earnings.

Even as corporate investments shift from DEI causes to other philanthropic causes, those dollars remain in budgets for charitable investments in other areas strategically aligned with corporations’ businesses. As profits rise, nonprofits can identify potential alignment and investment with corporations.

Continued Economic Strength is a Sign of Hope

This year’s Giving USA report presented better than expected recovery in the philanthropic space driven in part by a better-than-expected recovery of key philanthropic giving indicators.

- A resurgent stock market provided foundations with greater assets to give and individuals with appreciated assets conducive to larger, more tax-advantageous giving.

- Corporations’ strong profits created an opportunity for increased investment in nonprofits.

- Wage growth amid cooling inflation instilled more confidence in base and mid-level donors that they could invest in impact amid a more certain economy.

Looking Ahead

Only time will tell if 2024’s giving results in new record highs and an across–the–board return to positive growth in giving across sectors, but nonprofit leaders and advancement professionals have the opportunity to deploy strategies in the second half of 2024 that will not only benefit their organizations but also continue to drive the recovery of the philanthropic sector.

Economic Optimism Creates Space for Aspirational Asks

As inflation fell from 6.1% to 3.1% over the course of 2023 and wages grew, giving increased. Last year’s giving data signaled that donors are once again focused on changing the world through philanthropy. Fundraisers and leaders need to recognize these changes as opportunities to engage donors in substantive conversations about meaningful philanthropy. Donors whose financial considerations have rebounded have an opportunity to aid continued recovery among other segments of the economy and to invest in helping nonprofits restore and grow their impact by giving to ensure continued program growth.

Strong stock market growth represents an opportunity for nonprofits to engage in conversations with foundations, previous IRA donors, and donors who have given stock in the past about tax-advantageous giving that could greatly benefit nonprofits and their causes.

As Inflation Cools, the Impact of Higher Long-Term Costs Will Linger

Nonprofits felt the impact of high inflation just like individuals and families did. The cost of delivering the same impact—be that serving as many families as possible, educating a student, or treating a patient—increased. Prices may never return to what they were, creating a structural challenge for boards, leaders, and fundraisers who need to do more with less while determining how to raise revenues over time.

Beyond increased program and administrative costs, nonprofits confront a radically different and more challenging labor market. The COVID-19 pandemic set in motion a seismic reordering of individual priorities, further fueled by recent years’ high inflation. Employees are looking for higher wages, remote or hybrid work schedules, and increased flexibility to enable a stronger work-life balance. These demands have placed increased pressure on nonprofits’ efforts to recruit and retain talent. Tight budgets have made nonprofit wages less competitive than what’s available in the for-profit sector. Nonprofit leadership turnover has been and continues to be high as burned–out leaders and staff leave the space in pursuit of something new.

Major and Principal Giving Programs Must Remain a Priority

The hope gleaned from 2023’s data comes through more prominently from certain sources than others. Bequest, corporate, and foundation giving exhibited a stronger recovery than individual giving. These trends track stronger economic recovery among corporations, stocks, and those with appreciated assets than the average base-level donor. This disparate recovery reinforces the need for development enterprises to focus on relationship-based major and principal gift programs—those focused on high–touch, high–ask philanthropy. Focusing on the most likely next big gifts will be an important determinant of near-term health and success for nonprofits.

Planned Giving Programs Should be a Priority Amid Bequest Strength

Bequest giving has consistently represented between 9% and 10% of annual philanthropy, despite being perhaps the most volatile source of giving each year. Demographic data suggest recent gains in the value of this source—the only one to outpace inflation in 2023—represent an opportunity in the years ahead. The U.S. Census Bureau reports that more than 77 million Americans are over 60 years old, representing a large portion of the population for whom estate planning is likely a strong consideration. That likelihood is fueled by the wealth of America’s older citizens. According to Bloomberg, Americans over 70 hold more than 30% of the country’s wealth and have added $14 trillion to their net worth since 2019.

Estate and legacy gifts have long been a source of considerable revenue for nonprofits, and the potential in the years ahead seems even greater. Nonprofits would be wise to ensure bequest conversations are ongoing with their donors over 60 who may be interested in leaving a lasting impact on that organization’s ability to fulfill its mission. More so, revisiting conversations with donors who have documented their bequests to see if the estimated value of the gift has changed represents an opportunity to uncover additional philanthropy and plan for its eventual impact.

Investments in Base and Mid-Level Giving are Critical to Long-Term Health

While growth and concentration of wealth among aging Americans creates significant near-term opportunity for securing philanthropic support, nonprofits must begin investing now in growing their base and mid-level giving programs to cultivate relationships with and retain these donors. Amidst worry about declining donor counts, nonprofits that thoughtfully build programs focused on retention and upgrading existing donors are beginning to see those trends slow and even reverse. Building loyalty among these donors is not only an opportunity to secure stable revenues now, but it is also a growing opportunity for transformational giving as these donors age into their prime giving years.

Donor Advised Funds Fuel Growth Across Philanthropy

Giving to Donor Advised Funds is accounted for within the sector the fund occupies. DAFs housed within community foundations count within gifts to foundations, while DAFs associated with financial organizations like Fidelity and Vanguard are accounted for within public-society benefit. The increased use of DAFs by savvy donors is undoubtedly fueling the growth of these sectors, though the exact magnitude of them as a driver is difficult to parse.

DAFs continue to grow as an opportunity for nonprofits and must be a priority for development professionals. The dollars in these funds have already been gifted by the donor and earmarked for a charity to be designated at a later date. Building relationships with donors with DAFs opens up a great source of funds in good times, and because the funds have already been gifted, they represent a great source of funding even in times of economic uncertainty. Building and maintaining relationships with these donors, in good times and bad, is key.

From “Will It?” to “How?”—The Role of Artificial Intelligence Grows

When OpenAI released ChatGPT in November 2022, the concept of generative AI moved from select circles into the mainstream. Nonprofits and fundraisers quickly saw new value in AI that could expedite writing or summarize pages of data. While these efficiencies save time, the true power of AI will come to bear not in how it can be used to expedite tasks but rather in how it employs data to inform actions and craft more focused fundraising strategies more likely to result in gifts.

Nonprofits need to develop AI and tech-forward approaches and include them in their strategic and operating plans. These approaches will be crucial to better utilizing staff time to do meaningful work and will be an important component of managing organizational risk in the face of rapidly evolving technologies. Organizations that fail to move quickly risk losing out on the gains those who move swiftly will unlock.

A Year of Conflict and Unrest Looms Large Over Philanthropy

Philanthropy is among the most powerful tools to solve the world’s problems. Yet, it is often shaped by those very problems. The war in Ukraine and the Israel-Hamas war continue to rage in 2024, drawing attention and support abroad. These conflicts will continue to shape donors’ priorities. Donors who give directly to international entities will not see their generosity captured and recorded in Giving USA data.

Women’s and family issue were brought further forward in 2024. The ripple effects of the Supreme Court’s Dobbs v. Jackson decision continue to reshape donor priorities across the political spectrum around these issues, and Melinda French Gates recently announced a commitment to give away $1 billion over the next two years in support of women and families.

Uncertainty looms large over the fall as well. Unrest on college campuses dominated headlines throughout the spring, as donors publicly criticized universities’ responses to antisemitism and protests on campus. Several donors have publicly stated reevaluations of their philanthropy, while others have announced large gifts to organizations outside the U.S. How these factors impact whether the education sector continues to grow remains to be seen.

All of this takes place alongside a contested presidential election. While elections have been found to have mostly negligible effects on giving, the Do Good Institute at the University of Maryland has found voting inspires individuals to engage in other prosocial behaviors, such as volunteering and giving. That may change in an era of increased grassroots campaign support and hardened political division, but outreach to individuals who vote represents an opportunity for nonprofits wishing to pursue it. The outcome of the election and the policies of its winner will impact the needs nonprofits must address in ways that will shape philanthropy throughout the next four years.

Philanthropy is Resilient

Philanthropy proved resilient in 2023, a year overshadowed by uncertainty and a worrying 2022 Giving USA report, thanks—above all else—to the generosity of donors and the hard work of nonprofit leaders and fundraisers to match that generosity with meaningful impact. Generosity is embedded not just within the American spirit, but also deeply within our humanity.

Through the uncertainty of 2024, we see incredible potential on the horizon for the nonprofit sector and those who support it. The opportunity to accelerate our sector through thoughtful fundraising practices and partnerships with donors remains bright.